VAT and oil revenue ‘will reduce budget deficit’

Higher VAT and oil revenue will help to narrow Bahrain’s budget deficit to under 4 per cent of GDP this year as the fiscal reforms push continues, according to an assessment by Emirates NBD.

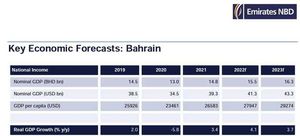

Authored by Khatija Haque, the banking groups’ head of research and chief economist, the report projects the kingdom’s GDP growth to accelerate to 4.1pc in 2022 as both oil and non-oil sectors rebound from the pandemic.

Bahrain’s economy grew 2.1pc year-on-year (YoY) in Q3 21, after recording rates of (-)2.8pc and 5.5pc in Q1-2021 and Q2-2021 respectively according to figures by the Finance and National Economy Ministry.

Growth during Q3-21 was led by the non-oil economy which expanded at 2.4pc in Q3-21. The oil sector contracted by 4.1pc YoY in Q3 21.

Emirates NBD has forecast 2021 GDP growth at 3.4pc following a contraction of 5.8pc in 2020.

However, the bank cautions that Bahrain’s Covid-19 dynamics may weigh on growth in Q1 2022 as the Omicron variant has caused case numbers to shoot up since early January.

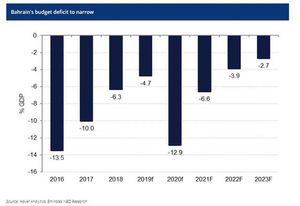

The budget deficit likely narrowed to around (-)6.6pc of GDP in 2021 from (-)12.9pc in 2020.

“We expect the deficit to narrow further this year to (-)3.9pc of GDP as Bahrain continues to implement fiscal reforms, including a doubling of the VAT rate to 10pc (effective 1 January 2022), streamlining subsidies and reducing expenditure. The government is now aiming to achieve its zero-deficit target by 2024, two years later than originally planned,” said Ms Haque.

Net foreign reserves at the central bank rose to $4.27bn in November 2021, more than double the level at the end of 2020. Import cover has improved to three months.

In November, the government announced new details about its $30bn post-pandemic Economic Recovery Plan. The plan is designed to drive growth, boost employment for citizens and attract $2.5bn in foreign direct investment by 2023, and increase VAT from 5pc to 10pc, as the seeks kingdom balance its budget by 2024.

The plan aims to create more than 20,000 jobs for Bahrain’s citizens annually until 2024, and train 10,000 more through its Tamkeen education program for the private sector.

It comprises 22 projects across important sectors, including telecoms, tourism, education, manufacturing, and health.

Key projects include the creation of five communities on newly constructed islands, eventually raising Bahrain’s total land area by more than 60pc.

Another key project is a new 25-kilometre, four-lane King Hamad Causeway that aims to increase cross-border trade and travel with Saudi Arabia and the wider GCC.

As part of the Economic Recovery Plan, the government launched the Industrial Sector Strategy (2022-2026), on Dec 30, 2021.

The plan aims to raise the contribution of the industrial sector to the GDP, to 14.5pc in 2026 from 12.8pc in 2019, and increase the employment of Bahrainis in the sector to 25.3pc of the total and with a target of employing 65,000 by 2026.

The targeted industries as part of the strategy, include the downstream industries such as aluminium and petrochemicals, renewables energy including blue and green hydrogen, sectors that will also contribute to the kingdom’s commitment to reach net zero carbon emissions by 2060. Other sectors include food, pharmaceuticals, and micro-electronics.

Earlier this January the government also launched the 2022-2026 Telecommunications, Information Technology and Digital Economy Strategy as part Economic Recovery Plan.

The strategy will focus on enhancing the digital policies and legal framework elements that are critic to developing the country’s digital infrastructure, in addition to ensuring comprehensive fiber-optics coverage across residential and commercial areas in Bahrain.

The government earlier announced almost 1300 services will be available through online government portals including the issuance of visas, marriage certificates, identity documents for newborns and post-construction services.