Support measures boost Gulf banks’ asset quality

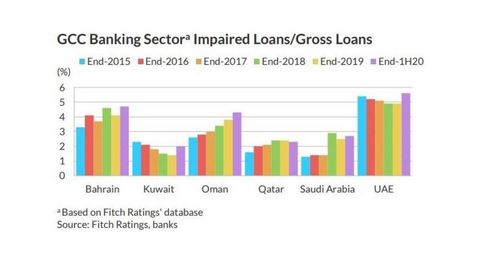

MANAMA: The risk to GCC banks’ asset quality following the economic shock due to the coronavirus pandemic and low oil prices is masked by extended support measures for borrowers, Fitch Ratings says in a new report.

Prolonged support measures will limit short-term pressure on asset quality, delaying the recognition of certain loans well into 2021.

Loans ratios rose slightly in 1H20, largely due to cash flow pressure on certain corporates that did not benefit from payment holidays or whose financial health was already weak.

However, asset-quality metrics could weaken much more materially in 2021-2022 once support measures are withdrawn, particularly if economic activity does not recover strongly.

Several GCC countries have prolonged their loan deferral schemes well into 2021.

The agency believes this reflects the authorities’ expectations that pressure on households and corporates could persist even as the economy recovers.

Rising unemployment is a major economic risk, as evidenced by employment surveys and unemployment rates already increasing, particularly in Saudi Arabia.

Fitch expects liquidity for GCC banks to remain adequate in 2021-2022.

The pandemic has not led to deposit withdrawals by governments or government-related entities, with governments instead favouring sovereign debt issuance in 2020, the proceeds of which have supported banking sector liquidity.

Household savings, which have grown due to limited spending opportunities during lockdowns, also support liquidity.

According to the ratings agency, GCC banks’ capital buffers are sufficient to absorb the likely deterioration in asset quality following the end of loan moratoriums in 2021.

Reserve coverage of certain loans is healthy and pre-impairment profitability buffers provide an extra cushion against deteriorating credit conditions, Fitch asserts.

Banks in the region took a prudent approach to provisioning for expected credit losses, frontloading their provisions in anticipation of severely weaker credit conditions.

This dented their profitability in 1H20, still at an early stage of the pandemic and well in advance of most of the asset quality deterioration that they are likely to experience.

The average cost of risk (loan impairment charges/average gross loans) is expected to have almost doubled in 2020, reflecting mainly forward-looking provisions booked by the banks.

Bahraini banks also posted modification losses until end-3Q20 as they could not accrue interest until then.

However, they have since been able to accrue interest.

Source: https://www.gdnonline.com/Details/935424/Support-measures-boost-Gulf-banks%E2%80%99-asset-quality