Saudi’s fintech sector starts to rival UAE, Egypt as number of firms nearly doubles

The number of companies in Saudi Arabia's fintech sector has nearly doubled and is starting to rival other markets in the Middle East and North Africa (MENA) region, including the UAE and Egypt, according to a new report.

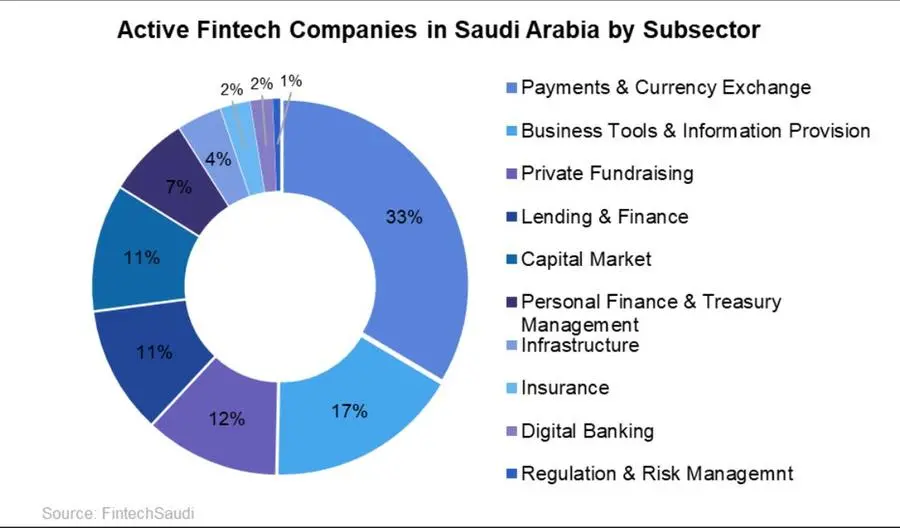

Through August 2022, the kingdom saw a 79% year-on-year (YoY) increase in the number of operating fintech firms, according to the US-Saudi Business Council. As of the latest count, Saudi Arabia has 147 active fintech businesses, compared to just 10 in 2018.

Capital also continued to flow into the sector, which recorded SAR 1.5 billion ($402.2 million) in total investments between September 2021 and August 2022.

"This rapid expansion is due to liberalised business regulations, an active investment environment and well-developed technology infrastructure," the report said.

According to Albara'a Alwazir, Director of Economic research at the US-Saudi Business Council, fintech businesses accounted for the highest number of total investment deals in the first half of 2022.

Saudi Arabia looks to expand the number of active fintech players to at least 230 businesses, which will account for 70% of non-cash transactions, and boost the sector's GDP contribution to SAR 4.5 billion.

By 2030, the kingdom's fintech sector is expected to generate around 18,200 direct jobs and account for 525 active fintech companies by 2030. Saudi Arabia is also aiming to reach SAR 13.3 billion ($3.6 billion) direct GDP contribution by 2030, up from SAR 1.2 billion in 2021.

"Fintech companies attracted investments from leading domestic and international firms such as Sequoia, 500 Global and Mastercard. Well-developed technology infrastructure such as the widely accessible 5G and cloud services, a high domestic demand for financial services and continued government support have all supported ongoing growth," said Alwazir.

According to the council, there is a high demand for a variety of financial services among Saudi residents, particularly in the areas of banking, insurance, investment, asset management and Shariah-compliant financing. The high level of smartphone penetration and banked youth population has also enabled a relatively rapid transition to the digital economy.

In recent years, a growing number of Saudi consumers have also embraced the use of card and electronic payments, particularly during the COVID-19 pandemic.