Moody’s upgrades Bahrain's banking system outlook

Bahrain banks’ profitability will return to pre-pandemic levels over the next 12 to 18 months, forecasts Moody’s Investors Service, noting that resilient funding, liquidity and capital positions are back after the coronavirus economic shock.

In reports issued yesterday, the US-based ratings agency has changed the outlook for the banking systems of Bahrain, Saudi Arabia, Kuwait, the UAE, Qatar and Oman to stable from negative, as operating conditions improve after the pandemic.

“We have changed banking outlooks in Gulf Cooperation Council states as the jump in oil prices is boosting economic activity and economies are recovering after the coronavirus shock,” said Nitish Bhojnagarwala, vice-president and senior credit officer at Moody’s.

“Non-oil activities including tourism will also contribute to the improvement in some areas.”

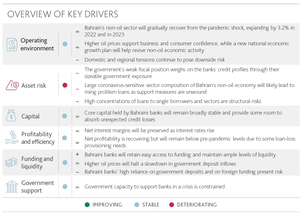

Moody’s expects Bahrain’s non-oil sector, where banks do most of their business, to expand by 3.2 per cent in 2022 and 2023 after bouncing back to 3.6pc in 2021 from a 5.9pc contraction in 2020 (0.4pc contraction in 2019).

Higher oil prices are easing government spending constraints and a new national economic growth plan will help revive the non-oil sector, it says.

Recovering business and consumer sentiment will support lending, while the easing of social distancing measures and travel restrictions – particularly the re-opening of the border with Saudi Arabia from where millions of tourists arrive on a yearly basis – will encourage a return to business as usual.

Off-budget spending on GCC-financed infrastructure projects will continue to provide business opportunities for banks.

Although the global fallout from Russia’s invasion of Ukraine is increasing uncertainty, the impact on Bahraini banks remains low at this stage given their limited direct exposure to both countries while any domestic and geopolitical tensions continue to present downside risks.

The agency expects core capital held by Bahraini banks to remain broadly stable as modest loan growth is balanced by profit retention.

It says the existing stock of problem loans is fully covered by provisions (at 110.3pc as of December 2021) providing an extra layer of protection.

Bahrain banks net profit will continue to improve, estimates Moody’s.

Net income recovered to 1.2pc of tangible assets in 2021 after dropping to 0.9pc in pandemic hit 2020 (1.5pc in 2019) but remains below pre-pandemic levels.

The recovery was spurred by a reduction in loan-loss provisioning charges.

The ratings agency expects some level of provisioning will still be required as forbearance measures are lifted.

Net interest margins will be preserved on expectations of rising interest rates, whereas tight cost control will help keep pre-provision profit at around 2pc of average assets, it explains.

Funding requirements will be low due to modest loan expansion, and loans were a comfortable 78.8pc of deposits as at December 2021.

Identifying vulnerabilities, Moody’s says large concentrations of deposits from single depositors (particularly from the government and its related institutions) and high volumes of foreign-currency liabilities remain vulnerabilities, although most of the funds are stable and come from neighbouring GCC countries.

Source: https://www.gdnonline.com/Details/1060754