Middle Eastern wealth funds are readier than ever to shine - Global SWF

The position and momentum of Middle Eastern sovereign wealth funds (SWFs), especially in the GCC nations, are much better this year due to an average oil price of $99/barrel and to the peg of their currencies to the dollar.

For those GCC economies with lower fiscal expenditure, this translates into large surpluses, which were transferred to some of the SWFs at the end of the year. Therefore, the large savings funds that are more liquid and internationally focused, including Abu Dhabi’s ADIA, Kuwait’s KIA and Qatar’s QIA, are set to receive significant inflows of capital, Global SWF said in its annual report.

The strategic funds that have large portfolios of domestic assets, such as Mubadala and ADQ in Abu Dhabi, ICD in Dubai or Mumtalakat in Bahrain, do not expect any major capital injection, but will not endure such large losses either, because of the more limited exposure to traditional bonds and stocks.

"In summary, investors from the region will emerge even stronger from the current economic scenario. In this context, Middle Eastern SWFs are readier than ever to shine. Overseas, they have more than doubled their investments in Western economies, including the US and Europe, from $21.8 billion in 2021 to $51.6 billion in 2022," Global SWF said in its annual report.

Of the top 10 most active sovereign investors this year, five are from the GCC region.

Growth of SWFs by 2030

ADVERTISING

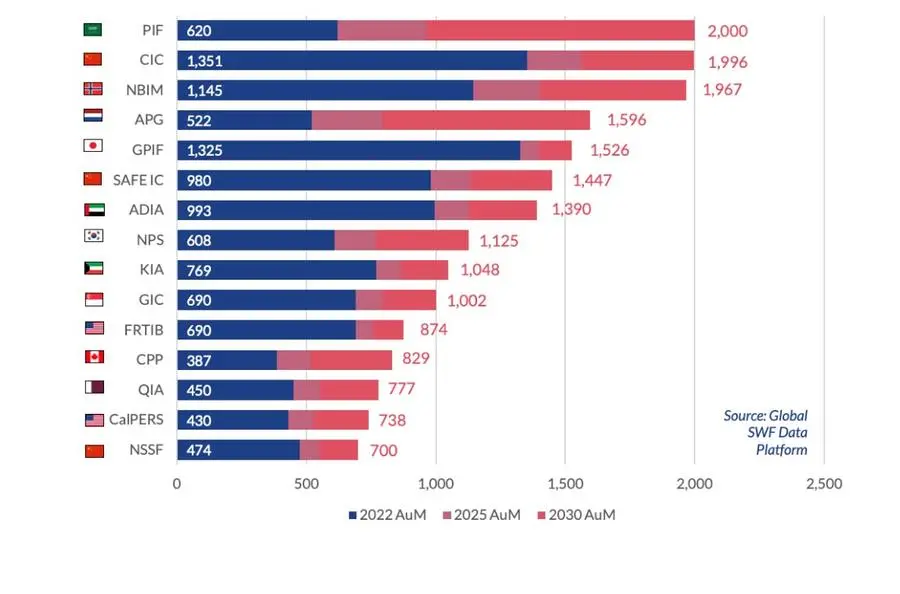

Sovereign wealth funds (SWFs) are expected to grow from an estimated $10.6 trillion in 2022, to $ 12.6 trillion by 2025, and to $17.3 trillion by 2030. This will be growth in AuM but also new funds that may arise from excess revenues or the need for capital, according to Global SWF.

Public pension funds will keep benefiting from consolidation and increasing contributions, and is expected to grow from today’s $20.8 trillion to $24.6 trillion by 2025, and to $33.2 trillion by 2030, the report said.

There will be at least 500 SOIs by 2030 and some of them, if established, may become very significant and could contribute to the growth of the industry, Global SWF noted.

The four largest funds in the Middle East will likely continue in the Top 15 by 2030, when Saudi Arabia’s PIF may eventually lead the table with $2 trillion.

Top 15 state-owned investors (SOIs) by AuM (US$ billion)