‘Massive opportunity’ in sustainable investment

MANAMA: More than $12 trillion in new sustainable investment opportunities will exist globally by 2030, making a strong business case in favour of sustainable finance, a leading Bahrain-based expert has said.

According to Dr Ali Ibrahim, chair of the sustainable development committee of the Bahrain Association of Banks and head of sustainability and social responsibility at Al Baraka Banking Group, sustainable finance enables banks to align their financing/asset portfolio with the United Nations Sustainable Development Goals (SDGs) and by incorporating Environmental, Social and Governance (ESG) considerations.

Speaking during a Bahrain Bourse (BHB) organised webinar yesterday, he said there is a strong business case in favour of sustainable finance as the majority of ESG funds have outperformed the wider market over the past 10 years.

The expert said a “massive opportunity” lay ahead for those looking to achieve sustainable economic recovery coming out of the current recession.

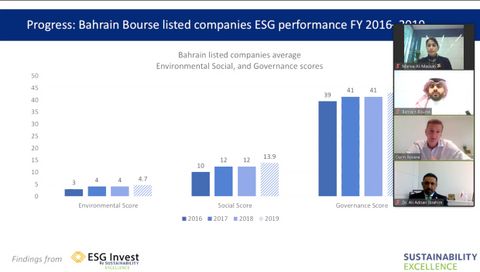

During the webinar, Dr Ibrahim also discussed ESG in the banking sector, shedding light on the implementation of such reporting by banks in Bahrain.

Awareness

The event was part a series of BHB workshops aimed at enhancing awareness and understanding of the importance and benefits of ESG reporting and encouraging listed companies in disclosing ESG information.

BHB issued its ESG Voluntary Reporting Guideline last month to assist listed companies in addressing ESG issues in their reporting for meeting the requirements of institutional investors for material ESG information.

Marwa Almaskati, the director of marketing and business development at the bourse, said following the issuance of the guideline, BHB was keen to build on the initiative by enhancing the concept of ESG reporting among listed companies, contributin to the development of sustainability in Bahrain’s capital market.

Also speaking in the webinar was advisory firm Sustainability Excellence’s founder and chief executive Darin Rovere, who agreed with Dr Ibrahim saying responsible investing has grown exponentially over the last decade, fuelled by the performance driven attributes of integrating ESG factors in investment decisions.

“It is critical for listed companies to report on key ESG factors to meet the growing requirements of investors, credit rating agencies, sovereign wealth funds, banks, stock exchanges, and regulators for material ESG information,” he added.

The webinar was attended by more than 30 representatives from listed companies and other financial institutions.

Source: http://www.gdnonline.com/Details/838878/‘Massive-opportunity’-in-sustainable-investment