Islamic finance ‘could reach $5.9trn by 2026’

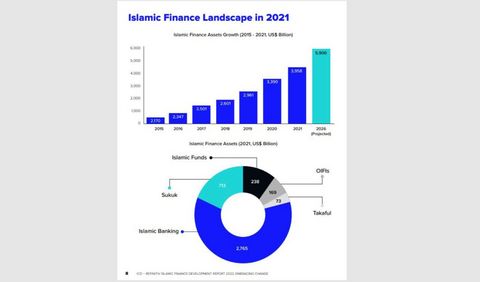

The global Islamic finance industry is expected to reach $5.9 trillion by 2026 from $4trn in 2021 driven by Islamic banks and sukuks according to the 2022 Islamic Finance Development Indicator (IFDI) released by Refinitiv and the Islamic Corporation for the Development of the Private Sector (ICD).

The indicator is a composite weighted index that measures the overall development of the Islamic finance industry.

The data is comprehensively gathered from a universe of 136 countries and measured across more than 10 key metrics, including knowledge, governance, sustainability, and awareness.

Malaysia led the IFDI list this year with a score of 113, followed by Saudi Arabia (74), Indonesia (61), Bahrain (59), Kuwait (59), UAE (52) and Oman (48).

The Gulf Cooperation Council (GCC) has the highest average score while the United States and countries in Europe have the lowest.

According to the indicator, Islamic banking currently holds 70 per cent of the global Islamic finance industry while sukuks grew by 14pc in 2021 to $713bn. Islamic funds, the third biggest sector, saw standout growth of 34pc to $238bn worth of assets under management in 2021.

The report notes that Islamic banking breathed a sigh of relief as provisions for credit losses eased, pushing up net income substantially.

In some instances banks benefited from extended government support to sectors that were pandemic-hit whereas a small number gained operational efficiencies from moves such as branchless banking and partnering with fintechs.

Other Islamic financial institutions (OIFIs) – including financial technology companies, investment firms, financing companies, leasing and microfinance firms, and brokers and traders – grew by 5pc to $169 billion worth of assets.

Takaful was the smallest sector of the Islamic finance industry, holding $73bn in 2021 on the back of a strong 17pc growth.

The sector is undergoing consolidation in the GCC countries that will streamline and reduce costs.

Hani Sonbol, acting chief executive of Islamic Corporation of Development of Private Sector, said: “We are optimistic for the continued double-digit growth of the global Islamic finance industry.

The big and more mature Islamic finance markets such as the six countries of the GCC, Malaysia, and Indonesia, continue to strengthen their industries and lead with developments and innovations in segments like Islamic fintech, regulations and sustainability.”