India’s education sector ‘a $225 billion opportunity’

MANAMA: India’s education sector is a $225 billion opportunity, according to new research by Investcorp.

A white paper released yesterday by the Bahrain-based alternative investment firm analysing investment opportunities in India’s education infrastructure sees the industry growing at 14 per cent annually over the next few years to reach an overall size of $225bn.

The research finds that the rapid growth of private K-12 schools and increasing focus on building an asset-light scalable business offer significant growth potential to investors.

It states that the Indian education sector has been growing at a double-digit rate in recent years, riding on long-term growth drivers like favourable demographics and recession-proof spending.

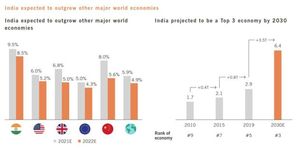

As per IMF estimates, India’s GDP is expected to grow at a pace of 9pc during FY23 and average growth rate of 8.3pc per annum during 2021-2026, overtaking China to become the fastest growing large economy in the world.

With a nominal GDP of $2.9 trillion in 2019, India became the world’s fifth-largest economy and third-largest in the world by purchasing power, with the second-highest population of any country in the world.

The white paper highlights how the private K-12 sub-segment, which constitutes around 50pc of the growing Indian education industry by revenue, is responding to this long-term growth opportunity by focusing on operations, quality, and brand building.

Private K-12 operators are also embracing technology and becoming asset-light, resulting in more capital efficiency.

Ritesh Vohra, partner and head of real estate at Investcorp India, said: “The private K-12 education sub-segment has seen growing institutional investor interest and has seen transactions in excess of $700 million from 2016 to date, involving investments across the operating business and/or physical infrastructure segment.

The edu-infra sector offers a meaningful opportunity to create a diversified portfolio of physical education assets and lease them to reputed and established school operators on a long-term basis, while providing school operators with requisite capital for their expansion.

We believe that investments in the Edu-Infra sector can generate stable and regular yield to investors over a period of 20-25 years, along with attractive capital appreciation.”

The white paper notes that in India, the spending on education is typically non-discretionary in nature without cutbacks even during economic downturns.

Mr Vohra

The spending as a percentage of the overall consumption expenditure is generally higher in comparison to more advanced economies and comparable emerging economies.

International investor interest towards India has grown manifold as evidenced by cumulative FDI inflows of $440bn during the last seven years.

Investcorp’s India real estate team invests in diversified real estate projects located in top tier cities.

So far, the business has deployed over $250m across 26 residential projects and has also partnered with a market-leading warehousing developer-operator.

The firm is also active in the mid-market private equity space in India and has invested across the consumer tech, healthcare, financial services, retail, SaaS, e-commerce, and technology sectors.

Its investments over the last four years include Intergrow Brands, Bewakoof.com, Freshtohome, Zolo, InCred, Citykart, ASG, NephroPlus, Unilog, XpressBees, and Safari Industries.