High food prices will raise Saudi inflation to 2.4% in 2022 - Jadwa Investment

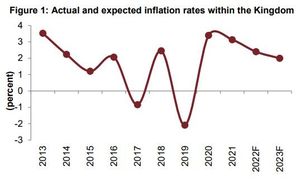

Jadwa Investments has revised their 2022 inflation forecast for Saudi Arabia upwards from 1.7% to 2.4% as the Russia-Ukraine war, Covid-19 related lockdowns in China and higher food consumption during Ramadan all add to price pressure, particularly on food.

According to the Riyadh-based investment bank, the kingdom sourced around 45% of all its wheat from Russia and Ukraine last year. Initial data suggests the cost of purchasing wheat in Saudi Arabia has risen 40% so far this year, it said.

The lockdowns in parts of China also risks adding to the already strained global supply chains and translating into higher imports costs from key trading partners such as Saudi Arabia, it said.

Additionally, higher consumption of food and beverages traditionally observed during the holy month of Ramadan is likely to add to food related price pressure locally, even if temporarily.

Within the CPI basket, ‘Food and beverages’ prices rose by an average of 2.4% year-on-year in February in Saudi Arabia versus 2% in January, and an average of 1.4% in Q4 2021. Despite this relatively low rise, prices of bread and cereals rose by 1% y-o-y in February, the highest rise since June 2021.

Within this segment, wheat and flour prices have seen jumps of 3.8% and 3.6%, respectively, so far this year.

Jadwa said: "Looking ahead, we expect further rises in global food prices to put upward pressure on food prices locally. For instance, 45% of the kingdom’s imports of wheat come from either Ukraine or Russia, with the current cost of wheat purchases already up 40% year-to date, versus full year 2021 prices."

Elsewhere, the Housing index is also seeing pressure. There is a higher demand on rentals, with the uptick being supported by the rebound in the number of expatriate workers with non-oil activities rise.

With “robust levels of non-oil activities growth anticipated in 2022 (at 3.4% according to our forecasts), we expect further rises in the number of expat workers, which, in turn, could see the ‘rentals for housing’ segment recording its first yearly rise since 2016.”

However, with the US Federal Reserve raising interest rates by 25 basis points (bps) recently and signalling further hikes during the remainder of the year, "we expect the value of the dollar (and therefore the Saudi riyal) to rise, which should help insulate the kingdom’s import costs somewhat during the year," Jadwa noted.