Fintech revenue in Menap ‘could increase threefold’

Fintech revenue in the Middle East, North Africa and Pakistan (Menap) region could increase almost threefold, from $1.5 billion in 2022 to $4.5bn in 2025, according to research by global consultancy McKinsey.

This would boost fintech’s share of financial services revenue from less than one per cent last year to approximately 2.5pc then, the report forecasts, attributing the sector’s continued growth to the region’s positive macroeconomic outlook, the consistently strong performance of its financial services industry as well as funding increases and revised licensing regimes.

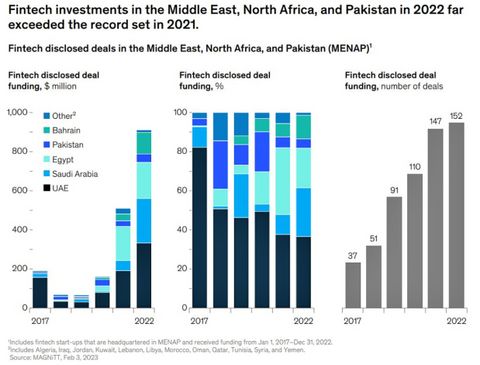

Growth in the sector has been robust in recent years, with investor backing increasing by approximately 36pc annually from 2017 to 2022.

Investor funding for fintech start-ups in Menap more than quadrupled from nearly $200 million in 2020 to approximately $885m in 2022, according to MAGNiTT.

Over the same period, the share of rounds exceeding $10m increased from 4pc to more than 15pc.

The McKinsey report notes that the recent surge in funding has been particularly strong in Saudi Arabia, Egypt and Bahrain as well as in the United Arab Emirates (UAE) with the number of firms scaling in these markets growing rapidly.

These markets have strengthened their position as crucial hubs for innovation, with the UAE attracting 37pc of funding in 2022; Saudi Arabia, 25pc; Egypt, 20pc and Bahrain, 12pc.

Rain, a Bahrain-based cryptoasset exchange that has raised $228.7m in funding since its founding in 2017 is reported to have reached $1bn in trading volume in 2021.

As part of its research, McKinsey spoke to leaders of 90 firms active in the region, including start-ups, bank and non-bank incumbents, and investors.

It concluded that fintech innovators could play an increasingly significant role in the way consumers and businesses in Menap conduct daily transactions and build wealth for the future.

Realising this potential would require that diverse actors reinforce the fintech ecosystem with capital, regulatory and market harmonisation, talent, and partnerships, the report suggests.

Nearly all founders interviewed by McKinsey assert that a multicountry strategy is crucial to meeting growth targets and achieving an impact comparable to fintech leaders in India, the US, China and other major markets.

They also cite business resilience and sustainability among the benefits of a broad geographic footprint. Solution providers in any market often face significant challenges when entering a new segment or adjacent market, and start-ups expanding across Menap take various steps to tailor their offerings and strategy to fit local needs and expectations.