Banking sector continues to record growth as profits fall

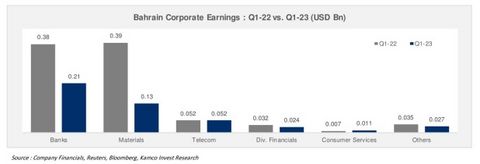

Total net profits of Bahrain-listed companies fell by nearly half in the first quarter of 2023, from $898.9 million in the same period of 2022 to $452.2m.

Four out of the five largest sectors by market capitalisation – banks, diversified financials, materials and telecoms – saw their aggregate net profits decline year-on-year (y-o-y) in the quarter, reveals analysis by Kuwait-based Kamco Invest.

In addition, nine out of 13 sectors on the Bahrain Bourse reported declines in aggregate net earnings for the first quarter of 2023.

The banking sector saw its total Q1-2023 net profits decline by 44.4pc y-o-y to $213m as compared with $383.4m in Q1-2022.

The results for the sector excluded net profits for AUB Bahrain post its merger with KFH.

Five out of the eight banks in the sector, which reported their financials during the quarter, posted y-o-y growth in profits in Q1-2023.

However, decline in profits for United Gulf Holding, Bahrain Islamic Bank and Al Baraka Bank resulted in a drop in profits for the sector.

Net profits for Bank ABC jumped 93.6pc to $60m in Q1-2023 up from $31m in Q1-2022, whereas first quarter net profits for NBB and BBK saw double-digit profits growth to $59.4m and $53.3m respectively, during the period.

In the materials sector, Q1-2023 net profits for Alba fell 67.7pc y-o-y to $125.9m as compared with $389.3m in Q1-2022.

The company attributed the fall in Q1-2023 profits to lower LME prices and lower premiums.

The telecom sector’s Q1-2023 earnings stayed the course with a marginal dip of 0.2pc to $51.5m.

Beyon Group (formerly Batelco) reported a 0.6pc growth in net profit to $47.7m led by improved revenues and operating profits during the period.

On the other hand, net earnings for Zain Bahrain declined by 8.9pc to $3.8m from $4.2m in Q1-2022.

Zain Bahrain’s y-o-y profit reduction was attributed to a drop in operating profits which saw a decrease of 11pc from $4.6m to $4.1m during Q1-2023.

Looking at the region as a whole, quarterly profits reported by GCC-listed companies declined y-o-y during Q1-2023 mainly led by a fall in energy and commodity prices.

Most commodity prices witnessed a demand-led shrinkage during the quarter that was reflected in the biggest quarter-on-quarter (q-o-q) drop in the Bloomberg Commodity index since the pandemic during Q1-2023 (down 6.5pc).

A fall in profits for the diversified financials sector was also reflected in lower profits during the quarter after the MSCI GCC index declined for four quarters in a row.

That said, aggregate GCC profits showed the first q-o-q growth in Q1-2023 after two consecutive quarters of reversals.

Aggregate net profit for GCC-listed companies reached $61.5 billion during Q1-2023 as compared with $57bn during Q4-2022 resulting in a q-o-q growth of 7.9pc.

The y-o-y performance showed a decline of 9.1pc when compared with Q1-2022 profits of $67.9bn, which was the second-biggest profit on record for the GCC markets.

Energy, materials and diversified financials were the top three sectors by absolute y-o-y profit decrease versus Q1-2022 as these sectors accounted for 56pc of total profits during Q1-2023 as compared with 70pc of profits during Q1-2022.

In terms of q-o-q performance, the growth in profit was led by higher profits for banks and utilities sectors that was partially offset by a drop in profits mainly for the energy, capital goods and materials sectors.

As for sectoral performance, profits for the energy sector fell by 16.9pc y-o-y or by $6.7bn and 4.8pc q-o-q or by $1.7bn during Q1-2023 to $33.1bn.

The decline in profits for the Energy sector highlighted a consistent drop in oil prices since last year.

Brent crude oil averaged at $81.1 per barrel during Q1-2023 which was the lowest in five quarters.

Nevertheless, the q-o-q slump in profits was seen in 12 out of the 22 constituents in the sector while nine out of 22 companies reported a y-o-y drop in profits indicating a fall in profits for some key large-cap companies in the sector more than offsetting growth for the rest of the companies.

On the other hand, the banking sector continued to record earnings growth during Q1-2023.

Aggregate profits for the sector surged by 20.6pc y-o-y and 24.9pc q-o-q to $13.3bn during Q1-2023.

The growth in profits was broad-based and was seen across the board in almost all markets in terms of both y-o-y and q-o-q performance.

It mainly reflected higher overall interest rates as the effect of the recent rate hikes were partially reflected in the results of the GCC banking sector.

Meanwhile, the results of the GCC insurance sector were largely unavailable as companies in the sector grapple with the implementation of the new IFRS 17 accounting standards that have taken effect from January 1, 2023.

Furthermore, profits for the utilities sector also saw significant gains during the quarter.

Total profits for the sector reached $3.3bn in Q1-2023, more than double when compared with Q1-2022 as well as Q4-2022.

Source: https://www.gdnonline.com/Details/1254180