Bahrain’s real estate deals surge 46pc to $2.66bn

Property transaction values in Bahrain reached BD1 billion ($2.66bn) in 2021, growing by an impressive 46 per cent annually, underpinned by government initiatives and an improving outlook.

Based on data from the Survey and Land Registration Bureau (SLRB) and the Real Estate Regulatory Authority (RERA), real estate services provider Savills is expecting this strong growth momentum to have a positive impact on the kingdom’s asset pricing in the medium-term.

The company’s Q4-2021 update on the Bahrain market notes that the government revealed a four-year National Real Estate Plan 2021-2024 in March 2021 to promote investments into the sector, develop innovative real estate enterprises, and preserve all the stakeholders’ rights, thereby creating a secure and transparent real estate sector.

In October 2021, the government announced a new national economic growth and fiscal balance plan. The multi-year, five-pillar plan is one of the largest economic reform programmes for the kingdom and aims to improve Bahrain’s long-term competitiveness.

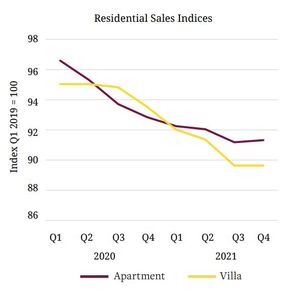

“Offshoots of a gradual recovery in the market were already visible as the Q4 2021 Savills residential capital value index remained stable,” said Swapnil Pillai, the firm’s Middle East associate director for research.

“This was the second consecutive quarter where prices across the residential sector remained unchanged across apartments and villas.”

However, Mr Pillai added that on an annual comparison prices remained on average 1.6pc and 4.2pc lower across apartments and villas, respectively, compared to Q4 2020, creating room for increased investments.

The residential rental index for Q4 2021 remined relatively stable on a quarterly basis; however, similar to capital values, on an annual comparison, rental values across apartments were 5 per cent more affordable.

The decline in prices was more prominent across the mid-end (3.5pc year-on-year) and high-end (1.4pc) segment, whilst they remained stable across the low-end segment, indicating that this sub-market is potentially bottoming out.

Across villa developments, annual rental value correction was marginal, with an average year-on-year (y-o-y) decline of 1.6pc.

The price correction was only observed for mid-end and high-end properties, whilst the low-end villa market experienced a y-o-y average price increase of 1.9pc.

The average low-end villa rental prices now compete with mid-end apartment prices.

Savills head of professional services in Bahrain Hashim Kadhem said: “Looking ahead, we anticipate the high-end sale market will continue to witness delays in absorption with developers unwilling to revise their pricing strategies. However, they are still offering extensive incentives with many developers also partnering with banks to offer attractive mortgage products.”

In the commercial segment, the uncertainty in the office sector in Bahrain was reflected by an average y-o-y drop in office sales prices of nearly 2.9pc.

In the rental market, mid-end offices experienced an average y-o-y decrease of 13.3pc due to the dual effects of tenants who either sought cheaper, low-end alternatives, or relocated to higher-end office developments that offered competitive rates.

Mr Kadhem added: “Going forward, a deeper analysis of office space that’s required will occur. International tenants are likely to adopt hybrid working practices, leading to downsizing of existing spaces and take-up of smaller spaces. Also, there will be an increased focus on the repurposing of older stock that does not meet the Environmental Social and Governance (ESG) requirements of tenants.”

“The supply/demand imbalance in the residential and commercial sectors has been ongoing and is likely to continue through the year as supply still significantly outpaces demand. Initiatives such as the economic growth and fiscal balance plan, and more recently, the Golden Visa announcement are a step in the right direction – they will certainly help stimulate real estate demand albeit over a period of time.”

Source: https://www.gdnonline.com/Details/1034157/Bahrain%E2%80%99s-real-estate-deals-surge-46pc-to-$266bn