Bahraini banks report highest net interest margins in GCC

MANAMA: Bahraini banks reported the highest net interest margins (NIMs) in the GCC at 3.45 per cent during Q4-2020, shows new analysis.

A report by Kuwait-based Kamco Invest found that aggregate NIM for the region during the quarter was 2.9pc, reflecting the decline in interest rates.

NIMs are a measure of the difference between the interest income generated by banks or other financial institutions and the amount of interest paid out to their lenders, relative to the amount of their interest-earning assets.

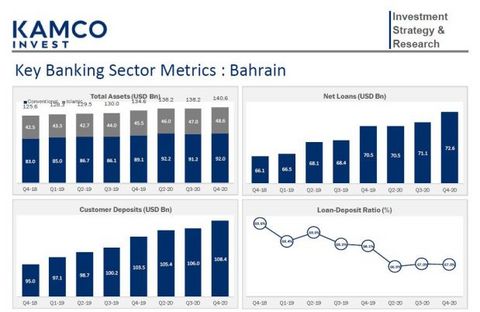

The report says Bahraini banks were joined by Saudi banks in clocking the region’s highest net loan growth during Q4-2020 of 2.2pc, whereas the aggregate for the GCC banking sector stood at 1.4pc quarter-on-quarter (QoQ) to reach $1.54 trillion led by a broad-based growth seen in most regional markets.

According to Kamco, the Covid-19 pandemic inflicted a deep impact on the GCC banking sector resulting in the highest provisions booked on record during FY-2020.

The 62 listed banks in the region reported loan loss provisions (LLP) of $20.3 billion during 2020 with increase seen across the board in all six countries.

Banks in the GCC set aside $6.4bn for doubtful credit during Q4-2020, the highest for a quarter ever recorded in the region.

Nevertheless, lending growth continued unabated in the region backed by economic recovery with gross loans (excluding Kuwaiti banks) reaching $1.4trn after a QoQ growth of 1.1pc during the December quarter.

Except for UAE, which reported a decline of 1.2pc, the rest of the countries in the GCC reported growth ranging from 1pc to 2.5pc in gross lending during the quarter.

The trend in net loans was similar witnessing a growth of 1.4pc with only UAE showing a marginal decline of 0.3pc.

As a result, earning assets reached a record high of $2.1trn with a QoQ growth of 1.6pc.

This pushed total assets for the banking sector in the region to a new record high of $2.6trn.

The increase in customer deposits was relatively marginal during the quarter with a growth of 0.4pc to $1.9trn.

The trend on this metric was uneven with growth seen in Bahrain, Saudi Arabia and Qatar, whereas UAE, Oman and Kuwaiti banks reported a decline.

The net impact of a faster growth in lending versus deposits during Q4-2020 was a growth in aggregate GCC bank loan-to-deposit (LDR) ratio to above the 80pc mark for the first time in three quarters at 80.1pc.

Meanwhile, S&P Global Ratings estimates that GCC banks can absorb a shock of $31bn-$45bn (in aggregate) with a limited automatic effect on its assessment of capitalisation.

Over the past 12 months, GCC banks have set aside $10.9bn of additional credit loss provisions for the expected negative impact of the Covid-19 pandemic and drop in oil prices on their economies, the US-based firm said.

Despite regulatory forbearance measures, which allowed banks to smoothen the profitability hit, cost of risk for GCC rated banks increased by almost two-thirds – reaching 150 basis points (bps) at year-end 2020 compared with 90bps at year-end 2019.

The agency expects banks’ asset-quality indicators will continue to deteriorate and cost of risk to remain high as they start recognising the true impact of 2020 and forbearance measures are lifted in the second-half of 2021.

Given continued low interest rates, the region’s banks’ profitability will remain low in 2021 and beyond, with some potentially showing losses this year.

Nevertheless, strong, and stable capital buffers, good funding profiles, and expected government support should continue to reinforce banks’ creditworthiness in 2021, says S&P.

Source: https://www.gdnonline.com/Details/940923