Bahrain ‘most affordable GCC country for financial firms’

Bahrain is the most competitive GCC country when it comes to costs of operating a financial services business, with the kingdom offering savings of up to 27 per cent over regional peers.

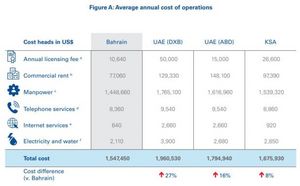

This was the key finding of KPMG’s Cost of Doing Business in the GCC 2022 report, which measured the direct and indirect annual costs associated with operating a financial services institution in selected GCC regions: Dubai, Abu Dhabi, Saudi Arabia, and Bahrain.

The 27pc annual cost advantage was calculated through direct costs, which are measured by looking at total costs related to business registration and licensing, commercial rental rates, workforce costs, telecom costs, Internet charges, electricity and water charges.

Bahrain compares favourably as an affordable country with the most competitive licensing costs, commercial rental costs, as well as utilities charges. For example, annual commercial rent costs is 32pc lower than GCC average.

Annual licensing fees are also another cost advantage for financial institutions in Bahrain – 58pc lower than the GCC average.

On the other hand, indirect costs present an overview of the average cost of living, focusing on the cost of education, residential utility costs, cost of renting residential properties, and domestic help remuneration.

Bahrain has also emerged as the most competitive GCC country in terms of the annual cost of living, 23pc below the regional average, and is the most favourable jurisdiction with regards to the cost of education, accommodation costs and domestic help remuneration in the select GCC countries.

When looking at both direct and indirect costs, the overall annual costs in Bahrain were 12pc lower than the average of select GCC jurisdictions.

Companies in Bahrain also enjoy many tax benefits, with zero taxes on corporate income and capital gains.

Dalal Buhejji, business development executive director for financial services at the Bahrain Economic Development Board (Bahrain EDB), said: “Bahrain’s competitive operating costs have always made it an attractive investment destination for financial companies.”

As the national investment promotion agency, the Bahrain EDB, supported by other government bodies, has attracted more than $1.1 billion worth of direct investments during 2022.

The investments are expected to generate over 6,300 jobs over the next three years in key sectors, including financial services, ICT, logistics, manufacturing, and tourism.

“The financial sector is a primary driver of Bahrain’s economy. In 2021, Inward FDI stocks for financial services stood at around $22bn, accounting for 66pc of Bahrain’s total inward stocks. The sector continues to be a focus for the Bahraini government and is considered a priority sector under the National Economic Recovery Plan, which was launched to further diversify our economy and broaden the scope of economic activities,” Ms Buhejji added.

The financial services sector is the largest non-oil sector in Bahrain, making up 17.7pc of its GDP (as of 2021).

Under the Economic Recovery Plan, the four-year financial services sector strategy (from 2022–2026) aims to increase the financial sector’s contribution to GDP in the range of 20pc until the end of 2026, and then increase the contribution to 25pc.