Bahrain-listed companies see profits surge 62.4pc

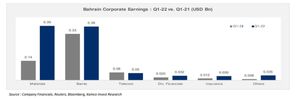

MANAMA: Bahrain-listed companies saw their net profits surge by 62.4 per cent year-on-year during the first quarter of the year to $922.5 million after key sectors posted an increase in earnings during the quarter.

Analysis by Kuwait-based Kamco Invest shows that the materials sector reported the largest net profit during Q1-2022 at $389.3m as compared to $138.4m during Q1-2021.

Alba, which is the only constituent of the sector, attributed its performance to higher LME prices which partially offset lower sales volumes.

In the banking sector, Al Baraka Banking Group and Ahli United Bank posted the largest increases in absolute net profits during Q1-2022 pulling up the total net profits of the sector which witnessed a 15.5pc overall increase to reach $384.5m.

Ahli United Bank reported $170.9m net profit in Q1-2022 as compared to $159.6m during the similar period of the past year.

Moreover, Al Baraka Banking Group reported a Q1-2022 net profit increase of 78pc which reached $45.6m compared to $25.6m for the same period in 2021.

The banks result was attributed to increases in net operating income and effective management strategy.

Quarterly net profit in the telecom sector declined by 8.4pc y-o-y to $51.7m down from $56.4m during Q1-2021.

The Q1-2022 net earnings, which were the third largest total profits among sectors, were weighed down by Batelco’s 9.2pc fall in profits.

The telco announced Q1-2022 net earnings of $47.5m as compared to $52.3m during the similar period of 2021.

The decline in Batelco’s net profits was attributed to increased operational expenses associated with setting up new digital entities.

Total Q1-2022 net earnings for the insurance sector jumped 150pc y-o-y to $29.9m driven by Bahrain National Holding which reported a threefold increase in net profit to $20.6m.

All the five companies which made up the insurance sector reported y-o-y profits increase during Q1-2022.

Comparatively, in the diversified financials sector, total net earnings reached $32.3m registering 61.3pc y-o-y increase.

GFH Financial Group posted profits of $19.1m, the biggest net earnings among companies in the sector, during Q1-2022 as compared to $16.1m to the similar period in 2021.

The company attributed the growth in net earnings to several key investment banking deals the group made during the quarter.

Meanwhile, profits reported by GCC-listed companies reached a new record level during Q1-2022 backed by a broad-based q-o-q growth across all sectors barring the consumer durables and apparels sector.

The higher profitability reflected a continued and sustained recovery in economic activity across the GCC during the quarter.

Aggregate net profit for GCC-listed companies reached $65.4 billion during the quarter as compared to $51.5bn during Q4-2021 resulting in a q-o-q growth of 27pc.

Source: https://www.gdnonline.com/Details/1114229/Bahrain-listed-companies-see-profits-surge-624pc