Bahrain ‘fastest growing fintech ecosystem’

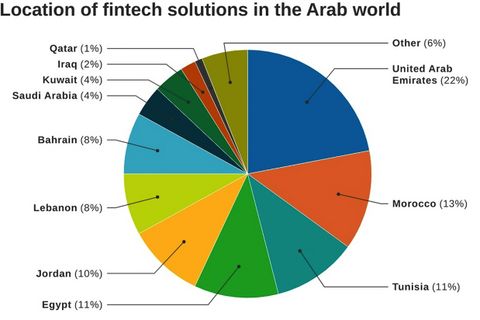

MANAMA: Bahrain has been named the fastest growing ecosystem in the Arab world for fintech solution development and roll-out, according to a two-year quantitative study by the Consultative Group to Assist the Poor (CGAP) at the World Bank.

The study surveyed 358 pure fintech solution providers, across 19 countries with active start-up ecosystems in the Arab region, concluding that the GCC led the region in financial inclusion as well as fintech innovation.

Nadine Chehade, financial inclusion specialist at CGAP, said during a webinar held last week by the MENA FinTech Association: “Bahrain was rising, as we were conducting this study, led by a pretty dynamic regulator, followed very closely by Saudi Arabia. In terms of products, payments was by far the number one category.”

Payment and remittance solutions make up 43 per cent of the fintech solutions in the region. While 64pc of the start-ups in the region are business-to-consumer (B2C) solutions, a number of them end up switching to business to business (B2B) solutions or become intermediaries as business-to-business-to-consumer (B2B2C) service providers.

Currently, 25pc of fintech companies are B2B and 11pc are B2B2C solution providers. The pivot from B2B to B2C and B2B2C comes as a result of the strict regulations that govern the industry.

The number of fintech companies in the region has been growing exponentially since 2012 and these providers have a higher five-year survival rate than average American fintech start-ups.

Fintech is the top category of start-up investments in the region, in terms of the number of deals, with $74million (BD28m) invested.

The study also identified key challenges across the region. 39pc of fintech companies do not have a clear revenue model, relying on user acquisition and long-term monetisation of user data, a strategy which is drawing increased scrutiny from venture capital funds during the Covid-19 pandemic, as the GDN reported on July 20.

While 66pc of adults in the GCC are now using electronic means to make cash payments, much higher than the global average of 46pc, only 76pc of the population in the GCC has access to a bank account, compared with nearly 95pc in OECD countries. Consumers and small and micro-enterprises (SMEs) are more likely to use informal borrowing services like saving associations and personal networks, a segment of the market now being targeted by start-ups like Egypt-based MoneyFellows and UAE-based CapitaWorld.

Arjun Singh, executive vice president of cards and payment at Dubai-based conglomerate Al Futtaim, said: “Fintech is about more than start-ups. There are some “mega-fintechs” rising globally and in the region. The opportunity is big. The penetration is low. There is a lot of potential, especially in terms of payments, but these start-ups have to think beyond the four-party model if they really want to disrupt the industry.”

In the traditional four party model, cardholders are issued credit or debit accounts by their banks who transact with the merchant’s bank via payment processing solution providers like Visa, Mastercard, RuPay and China’s UnionPay.

According to Mr Singh, as fintechs in the region mature, they should look to move their revenue models from transaction-based to those based on monetising data and selling value-added services.

Source: http://www.gdnonline.com/Details/838532/Bahrain-‘fastest-growing-fintech-ecosystem’