Bahrain Bourse back in the red despite insurance gains

MANAMA: The Bahrain Bourse (BHB) was back in the red during March 2021 after reporting marginal gains during February.

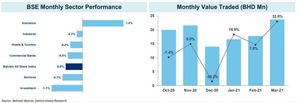

Research from Kuwait-based Kamco shows the Bahrain All Share Index closed last month at 1,458.03 points, registering a decline of 0.6 per cent making it the worst performing index in the GCC during the month.

Gains during the first half of the month were more than offset by declines during the latter half.

The monthly decline further pushed YTD-2021 decline for the benchmark deeper in the red at minus 2.1pc, also making it the worst performing market in the GCC this year.

The decline during March-2021 was broad-based as all the sectoral indices declined, barring Insurance that gained 1.4pc during the month.

The gain was mainly led by 4.5pc surge in shares of Bahrain Kuwait Insurance Company, whose shareholders will get a cash dividend of 15pc and bonus shares of 4.9pc.

The Insurance index also remained the top performer since the start of the year with a gain of 10pc followed by the industrial index with a gain of 0.6pc.

The rest of the index, meanwhile, reported YTD-2021 declines with the Services index reporting the biggest decline of 6.9pc, the Kamco report said.

The Investment index witnessed the biggest monthly decline of 1.1pc followed by Services and Commercial Bank indices with declines of 0.7pc and 0.5pc, respectively.

The decline in the Investment sector was mainly led by 2.1pc fall in shares of Bahrain Commercial Facilities (BCFC) followed by 1.1pc decline in shares of GFH Financial Group.

Shares of BCFC declined after the company reported losses during 2020 to the tune of BD4.3m as compared with profits of BD17.1m during 2019.

The losses came mainly on the back of a decline in net interest income coupled with impairments of BD20.5m.

Meanwhile, the decline in the Commercial Bank index was led by fall in shares of AUB (down 3.2pc) and Al Salam Bank Bahrain (down 2.9pc) that were partially offset by gain in shares of BBK (up 2.5pc) and NBB (up 4.9pc).

In the Services Index, Seef Properties was the biggest decliner with a fall of 3.2pc after the stock went ex-div with a cash dividend of BD0.005 per share.

The monthly gainers chart was topped by Nass Corporation with a gain of 36.1pc, although there was minimal trades in the stock.

Inovest was next with a gain of 14.5pc followed by Ithmaar Holding and NBB with gains of 10.2pc and 4.9pc, respectively.

On the decliners side, Khaleeji Commercial Bank topped with a decline of 20.8pc followed by APM Terminals Bahrain and Al Baraka Banking Group with declines of 13.9pc and 6.1pc, respectively.

Shares of APM Terminals Bahrain declined after the stock went ex-div towards the end of the month with a cash dividend of BD0.1518 per share.

Trading activity on the exchange showed growth for the third consecutive month in terms of value of shares traded that reached BD23.8m last month as compared with BD17.8m during February 2021.

Monthly volume of shares declined during March by 7.2pc to 81.4m as compared with 87.7m during the previous month.

AUB Bahrain topped the monthly value traded chart with BD7.6m worth of trades followed by Bahrain Duty Free Complex and GFH Financial Group with trades of BD3.6m and BD2.61m, respectively.

Looking at the GCC region as a whole, equity markets remained largely positive last month with gains in most markets except Dubai and Bahrain.

Trading activity in the GCC remained upbeat as well reaching a nine-month high at $92.2 billion with a monthly increase of 20.5pc during March 2021.

The sector performance chart for the month showed healthy gains across the board with all the sectors in the green.

Source: https://www.gdnonline.com/Details/940985/Bahrain-Bourse-back-in-the-red-despite-insurance-gains