Bahrain among nations attracting wealth inflows

MANAMA: Bahrain has seen a significant increase in investor interest from the global community of high-net-worth individuals, according to a report from Henley & Partners.

The firm, which is a global leader in residence and citizenship by investment, has released its Henley Private Wealth Migration Dashboard noting “interesting dynamics in the Middle East pertaining to both private clients and major sovereigns from an investment migration standpoint” as the pandemic gradually recedes.

Based on data from global wealth intelligence firm New World Wealth, which tracks the movement and spending habits of over 150,000 affluent individuals across the world, the dashboard is an analytical tool providing statistics and insights into global high-net-worth-individual migration and private wealth distribution and movement.

The report includes an article by Philippe Amarante, a managing partner at Henley & Partners and the head of the firm’s Dubai office, who lists Bahrain along with the UAE and Saudi Arabia as GCC destinations that are attracting wealth inflows.

“Much like the UAE, Bahrain applies a nimble, and therefore highly attractive, approach to private clients wishing to invest in the country’s real estate or industrial sectors. The recent start of the construction of the Bahrain-US trade zone as a regional centre for manufacturing, logistics, and distribution for American companies in the kingdom, in the GCC markets, and beyond, has increased Bahrain’s attractiveness,” writes Mr Amarante.

He also recognises the UAE as the “spearhead” of the GCC surge with “its competitive, agile approach to adapting regulations”.

The country remains a powerful magnet for capital and talent, pulling investors from all over the world either in a private capacity, with their businesses, or both, notes the expert.

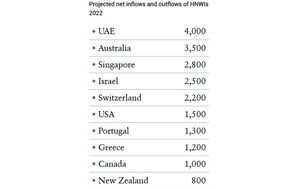

The UAE also leads the list of the top 10 countries globally in terms of net inflows and outflows of millionaires projected for 2022 (namely, the difference between the number of high-net-worth individuals who relocate to and the number who emigrate from a country).

Australia, Singapore, Israel, Switzerland, the US, Portugal, Greece, Canada and New Zealand round off the list in that order.

Net inflows indicates more high-net-worth individuals relocating to a country than leaving, while net outflows indicates more millionaires emigrating than arriving.

Nine of the top 10 countries for high-net-worth individual inflows in 2022 host formal investment migration programmes and actively encourage foreign direct investment in return for residence or citizenship rights.

Explaining the methodology of the dashboard, the report says the migration of high-net-worth individuals is an important gauge of the health of an economy.

Countries that attract high-net-worth individuals tend to be robust, with low crime rates, competitive tax rates, and excellent business opportunities, it adds.

Citing the 2022 World Investment Report by the United Nations Conference on Trade and Development (UNCTAD), a GDN report last Friday said Bahrain saw a 73 per cent jump in foreign direct investment (FDI) inflows to $1.8 billion in 2021.

The kingdom recorded the second highest value in FDI inflows in a decade, and also outperformed developing countries.

According to the report, the kingdom’s inward FDI stocks increased by 6pc from 2020, reaching $33.47bn in 2021.

With a GDP value of $38.8bn in 2021 according to the Information and eGovernment Authority, Bahrain’s FDI stock relative to GDP reached 86pc, ranking as the highest in GCC and surpassing the global average of 47pc.

Source: https://www.gdnonline.com/Home/Details/1114851