Evènements • Partners

Evolving tax landscape in Bahrain and the UAE by KPMG

Event ended.

In the UAE, the Ministry of Finance has recently published the new federal Corporate Income Tax (CIT) law effective financial years commencing on or after 1 June 2023. CIT implementation in the UAE will have a significant impact for Bahraini businesses with operations in the UAE or plans to commence operations in the UAE.

In Bahrain

– the National Bureau for Revenue (NBR) is considering the launch of e-invoicing having invited proposals for consultants to assist with the legal framework in addition to holding focus group sessions with large Bahraini taxpayers on e-invoicing; and

– the Minister for Sustainable Development at the recent World Economic Forum confirmed that Bahrain is considering the introduction of a corporate tax.

It is essential for tax and finance leaders at Bahrain businesses to keep up to date and ensure they are prepared for the upcoming changes.

Our expert speakers will cover

– Scope of the UAE CIT, exemptions, free zone taxation and foreign tax credits

– Impact of CIT on Bahrain businesses with operations in the UAE

– Potential introduction of CIT in Bahrain

– Basics of e-invoicing and key features of the KSA e-invoicing model

– Potential introduction of e-invoicing in Bahrain

– Practical steps Bahrain businesses can take to ensure readiness

About KPMG Bahrain tax team

KPMG in Bahrain has the most experienced, diverse and largest tax team in Bahrain – over 25 resident tax specialists (all based in Bahrain) with extensive VAT, GST, corporate and international tax experience gained globally across multiple jurisdictions and locally across the GCC – our depth and breadth of experience is unparalleled in the Bahrain market.

Our team has a combination of qualified tax lawyers, chartered accountants and technology specialists to ensure we bring you the best solutions and service by leveraging our industry/ sector knowledge, and experience within the marketplace.

Agenda

8:30 | Registrations and networking with refreshments |

9:00 | E-invoicing in Bahrain including lessons learnt from KSA |

10:10 | Break for networking with refreshments |

10:30 | CIT in the UAE and the potential introduction of CIT in Bahrain |

12:45 | Lunch and networking |

Registration

Please register by clicking here.

For assistance with seminar registration, please contact Khalid Seyadi (kseyadi(@)kpmg.com).

Speaker(s)

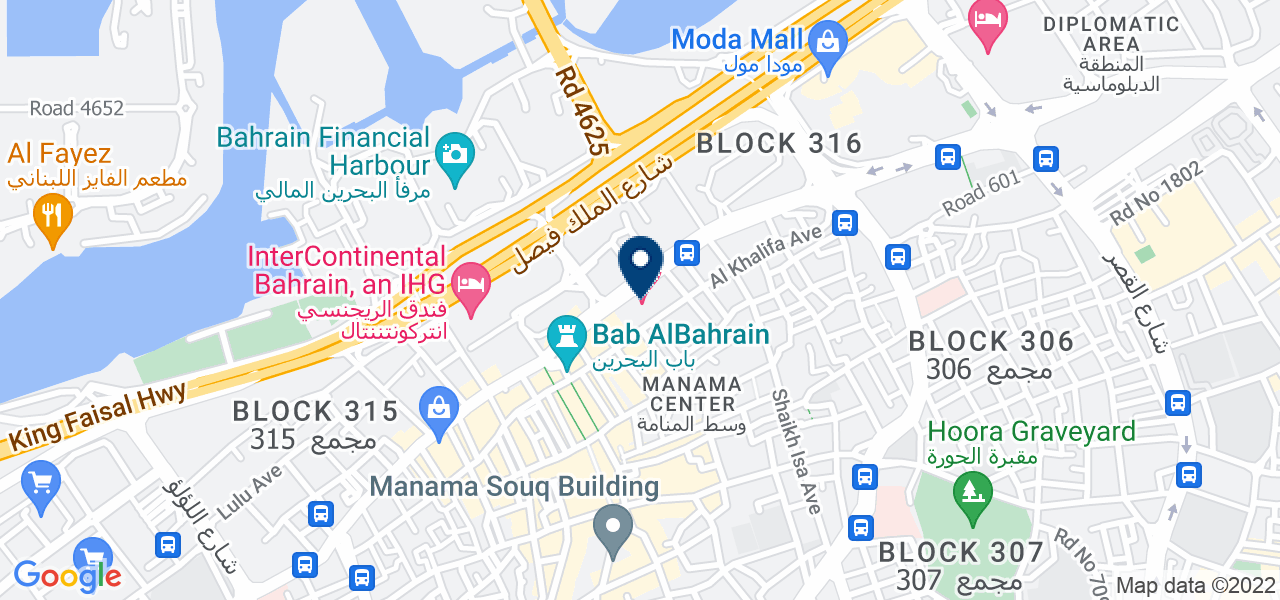

Event Location

Evolving tax landscape in Bahrain and the UAE by KPMG

Event ended.